Apple’s latest $500B investment in the United States may sound like a big deal, but it’s clearly just a continuation of what it’s done for quite a few years already.

On Monday, Apple announced it is making a $500 billion program of investment into the United States. The official press release said that it will be spread across the next four years, in a pledge that “builds on Apple’s long history of investing in American innovation.”

It sounds like a great thing that Apple’s suddenly making everyone aware of. A major company reinvesting in the country it’s based in is a good-news story and great PR, and one that builds political capital.

That the announcement follows one month after U.S. President Donald Trump boasted about CEO Tim Cook telling him about the “massive investment in the United States” gives it the feeling that Apple created the announcement so it had more agency over its reporting. At least, more agency than a relatively brief Trump claim.

This is certainly not the case. At all.

What Apple’s finer detailing of its investment plan confirms is that it’s a continuation of an ongoing investment routine for the company. One that the iPhone producer has been conducting for years, and not a sudden major investment plan instigated because of an election.

More granular than the figure suggests

The headline of the February 2025 investment announcement was that more than $500 billion would be invested into the U.S. economy over the next four years.

That $500 billion is certainly a lot of money, but it’s not going to one singular project or property. It’s a figure being spread across many different investments, all around the United States, over a long period of time.

As per Apple’s press release:

The $500 billion commitment includes Apple’s work with thousands of suppliers across all 50 states, direct employment, Apple Intelligence infrastructure and data centers, corporate facilities, and Apple TV+ productions in 20 states.

Facilities in various locations will be expanded, including locations in Michigan, Texas, California, Arizona, Nevada, Iowa, Oregon, North Carolina, and Washington.

Texas will also benefit from a new factory, consisting of a 250,000-square-foot server manufacturing facility due to open in 2026. This will produce servers used for Private Cloud Compute, the online processing element of Apple Intelligence.

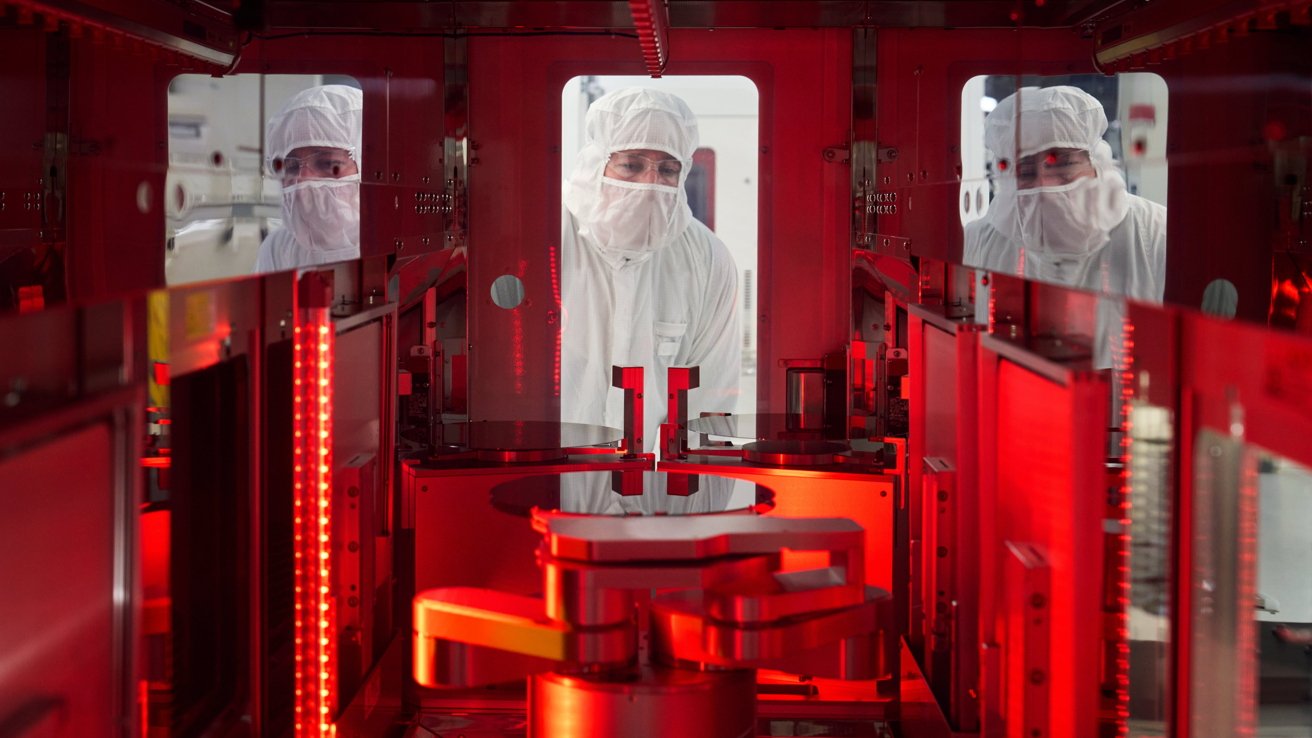

An Apple R&D facility in Austin, Texas – Image Credit: Apple

An Apple R&D facility in Austin, Texas – Image Credit: Apple

Then there’s the expansion of the U.S. Advanced Manufacturing Fund from $5 billion to $10 billion. The fund is used to provide investments to its manufacturing partners, which in turn adds more jobs to the supply chain.

Then there are its research and development investments, which have doubled in the last five years already. As part of its investment announcement, there will be the hiring of another 20,000 people for R&D work, as well as the expansion of R&D hubs.

Rounding out the latest list is educational efforts, starting with the new Apple Manufacturing Academy in Detroit. The initiative will combine Apple engineers with experts from universities to work with small and medium-sized businesses to use smart manufacturing techniques and AI via courses.

Education of students ready to enter the Apple-connected workforce is also being expanded, including grant programs for various organizations dealing with coding and other skills.

A $500 billion investment is a big figure, but it won’t stay that big for very long. The breadth of investment opportunities also demonstrates that it’s something Apple has planned to do for a very long time, with or without the political talking points.

Continual grand investment plans

The latest investment proclamation follows a trend by Apple to periodically declare spending plans for the United States.

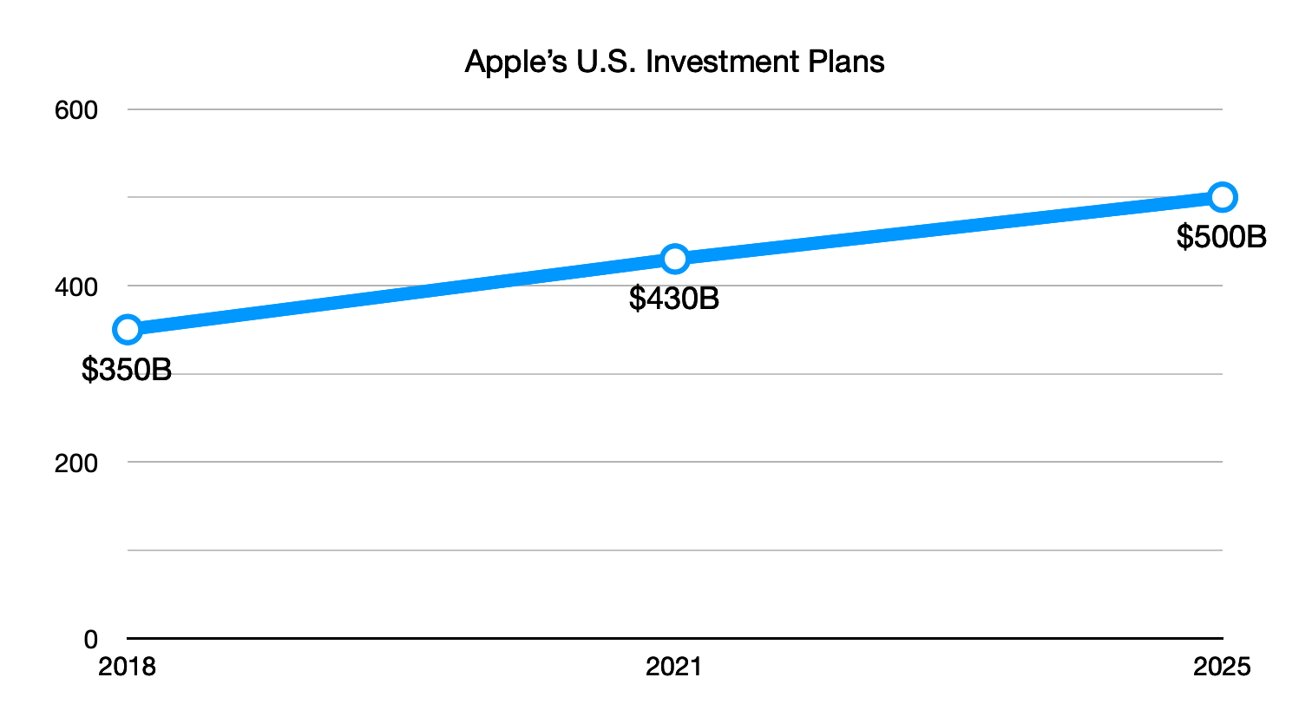

In 2018, Apple had set a five-year goal to invest $350 billion in the United States. At the time, it said that the investment would create some 20,000 jobs, including some to a new campus dedicated to AppleCare.

$10 billion was earmarked to go to data centers, the Advanced Manufacturing Fund grew $1 billion to $5 billion, and there were further plans to increase its educational initiatives.

Apple’s declarations of plans for U.S. investment have grown over time

Apple’s declarations of plans for U.S. investment have grown over time

A mere three years later, Apple boasted that its investment actions had significantly outpaced its original goal, and that it had plans for even more investment. This time an increase to $430 billion in U.S. investments over five years.

This included “direct spend with American suppliers,” data center investments, funding Apple TV+ productions, and generating thousands of more jobs. At the time, it was on track to create 20,000 new U.S. jobs by 2023 and decided to set another target of 20,000 more in another five years.

The $1 billion North Carolina campus and engineering hub was one major construction project, generating at least 3,000 jobs in machine learning and AI fields. Expansions in California, Colorado, Massachusetts, Texas, Washington, and Iowa were also touted by the company.

Then there were the investments with suppliers, including a $100 million Advanced Manufacturing Fund investment to a facility in Indiana and “tens of billions” across nine states for silicon engineering and 5G technology.

The latest $500 billion figure is, obviously, a natural progression for a continuing-to-grow company. While not quite a linear progression, with it slightly dipping down on an increase-per-year basis, it’s still very close.

Indirect investment

While Apple does claim it will be investing in various projects, including name-checking some important ones, a key thing to remember is how that investment takes place and how they are actually funded.

When it comes to manufacturing-related funding, Apple itself isn’t paying for the properties and the production lines. This is because Apple doesn’t handle manufacturing itself, instead handing it over to a supply chain partner to actually set up and operate.

For example, the 2025 investment plan’s Houston server production facility is described as being opened by Apple “and partners.”

However, according to a report from November 27, Hon Hai Precision Industry invested $33.03 million to buy land and a building in Texas. Also known as Foxconn, it has already got an AI server research and development center in Houston, and that Foxconn Assembly is registered in Houston.

Foxconn was using the purchase to expand its AI server production in the United States, the report said. While the report didn’t identify it as a project that directly involved Apple, the location and the production of the facility practically give it away that it’s directly linked to Apple’s investment plan.

It’s almost certainly an Apple-related purchase, but it is unknown how much of that figure was contributed by Apple for the project. It’s also unknown how much other funding Apple has provided to Foxconn for extra things like the production lines themselves, nor how much overall outlay Foxconn has to handle for itself.

Indeed, through things like the Advanced Manufacturing Fund and other more direct investment efforts, Apple provides funds to its supply chain partners to set up facilities and production lines, with a view to expanding its manufacturing footprint.

It may not be all of the associated costs for a supply chain project, but Apple does hand over a hefty chunk of cash when it stands to greatly benefit.

A continuing pattern

A company of Apple’s sheer size requires massive amounts of investment to continue operating and to grow. Apple has to spend considerable sums in all of its manufacturing centers around the world to make its supply chain bigger and better.

However, Apple’s U.S. investment announcements are a bit of an outlier for the company. It’s spending billions elsewhere on the planet, such as in India to diversify the iPhone supply chain in the face of international political issues and other global problems.

The most obvious issues that spring to mind include the U.S.-China tariff war and factories being temporarily shut down due to the COVID-19 pandemic.

Apple CEO Tim Cook with President Donald Trump during his first term

Apple CEO Tim Cook with President Donald Trump during his first term

Despite all of this investment elsewhere in the world, arguably to greater levels than that of its U.S. initiatives, Apple doesn’t usually promote its non-U.S. investments that much.

Investment in the United States is important to Apple as a company. But taking the moment to point out said investments is a practice that has very few real benefits to the company.

Limiting the announcements to the U.S. investment plan instead of discussing its whole-world investments is something that is targeted at elected officials, organizations, and investors keen to see Apple making those investments in the country.

Apple declaring that it’s spending billions on producing iPhones in India doesn’t offer any U.S. political goodwill to the company at all, and probably works against it. But Apple claiming it will spend billions in the U.S. offers considerable upside on that front.

The trillion-dollar company doesn’t have to say it will be spending so much on U.S. soil, as it has to as a matter of survival and growth. It does so because, for those with a vested interest in that sort of thing, it helps Apple’s political capital in its home country.

While somewhat helpful, Apple wouldn’t have made its announcement just to keep in front of Trump’s boast. It’s far more important than that.