iPhone 15 struggles in sales but older models pick up the slack

The latest iPhone models are falling short of expectations, with sales of the iPhone 15 lineup significantly lagging behind previous releases according to research data.

Consumer Intelligence Research Partners (CIRP) has released its latest results for iPhone sales in the most recent quarter, shedding light on the underwhelming performance of the new iPhone 15 models. The report marks the third full quarter of sales for the iPhone 15 lineup, including the base 15, the advanced Pro and Pro Max, and the iPhone 15 Plus.

The findings indicate that these models did not achieve the expected sales figures compared to previous launches.

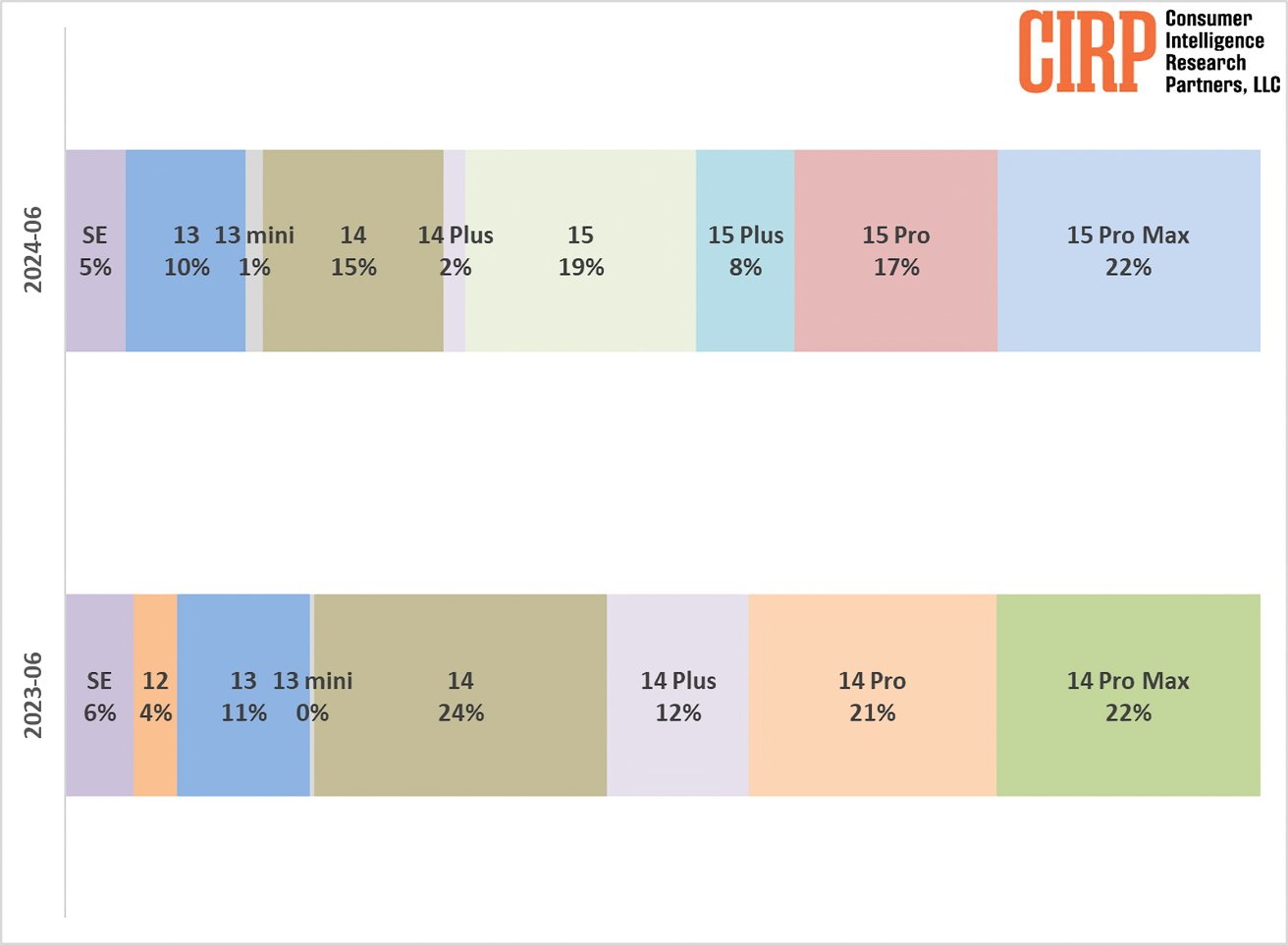

In the latest quarter, the four iPhone 15 models accounted for 67% of total iPhone sales, a notable drop from the 79% share held by the iPhone 14 models during the same period last year. The decline is evident across the board, with the basic iPhone 15 capturing only 19% of sales compared to the 24% share of its predecessor, the iPhone 14.

iPhone model mix (June 2024 Quarter)

The only exception to this trend is the high-end iPhone Pro Max, which maintained a consistent 22% share of sales in both periods.

Interestingly, legacy models have picked up the slack. In the June 2024 quarter, the iPhone 14 and 14 Plus models, now a year old, accounted for 17% of sales.

Those sales significantly increased from the previous year when the year-old iPhone 13 and 13 mini models only contributed to 11% of sales. The two-year-old iPhone 13 also performed better in 2024, capturing a 10% share compared to the meager 4% share of the two-year-old iPhone 12 last year.

The iPhone strategy

The underperformance of the iPhone 15 models also signals broader market dynamics. Consumers may be less inclined to upgrade annually as the smartphone market matures, leading to longer device lifecycles. These trends suggest a shift in consumer behavior.

One possibility is that the incremental upgrades in the newer models must be more compelling to justify the higher prices. Another factor could be the economic environment, prompting consumers to seek value in older, discounted models. The recent COVID-19 pandemic likely played a factor in budgets.

Apple’s strategy of maintaining and promoting older models is paying off, albeit not in the way it intended. The company’s product lineup now effectively serves different market segments, from those seeking the latest technology to those looking for more affordable options without significant compromises.